Credits and DeductionsĮarned Income Tax Credit (EITC) Assistantįind out if you’re eligible and estimate the amount of your Earned Income Tax Credit.

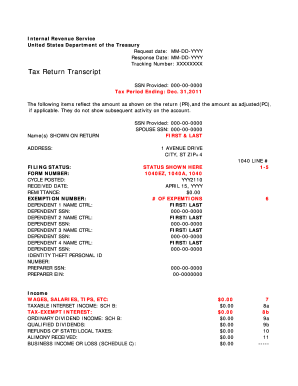

#Tax return transcript full

Make a guest payment (without registration) directly from your checking or savings account.įind out if you’re eligible to make payment arrangements on the amount of tax you owe if you can’t afford to pay all of it at one time.įind out if you’re eligible to apply for an Offer in Compromise, a settlement for less than the full amount of tax you owe. Refunds and PaymentsĬheck the status of your income tax refund for recent tax years.Ĭheck your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips, and more.Īccess your individual account information to view your balance, make and view payments, and view or create payment plans.

Search for preparers in your area who hold professional credentials recognized by the IRS. Get free tax help for the elderly, the disabled, people who speak limited English and taxpayers who qualify according to their income level.ĭirectory of Federal Tax Return Preparers Locate an authorized e-file provider in your area who can electronically file your tax return. Prepare and file your federal income tax online at no cost to you (if you qualify) using guided tax preparation, at an IRS partner site or using Free File Fillable Forms.

#Tax return transcript verification

Order copies of tax records including transcripts of past tax returns, tax account information, wage and income statements, and verification of non-filing letters.

For Individual Taxpayers AccountĪccess your individual account information to view your balance, make and view payments, view or create payment plans, manage communication preferences, access some tax records, and view and approve authorization requests. Use the Interactive Tax Assistant to find answers to your tax law questions.īrowse the tax tools available for individual taxpayers, businesses, and tax professionals.

0 kommentar(er)

0 kommentar(er)